Installing solar panels can help your farm or small business hedge against electricity price volatility and inflation. In many states, the price of electricity can fluctuate significantly due to demand, creating a headache for farm and business owners who are closely managing their cash flow. REAP grants have given thousands of farmers and business owners in rural areas across the country the opportunity to power their businesses with solar energy projects. These businesses are reducing and controlling energy costs, increasing energy security, and freeing up resources to re-invest in the local community.

The USDA’s Rural Energy for America Program (REAP) offers grants and loans to make solar more affordable.

In the state of Pennsylvania specifically, the amount of current investment in REAP projects is: $11,121,473.

What is REAP?

USDA Rural Energy for America Program (REAP) provides competitive grant funding and guaranteed loan financing to agricultural producers and rural small businesses for renewable energy systems and energy efficiency improvements.

Agricultural producers with at least 50 percent of gross income coming from on-site agricultural operations are eligible to apply for competitive grant funding and guaranteed loan financing through REAP. The Inflation Reduction Act quadrupled funding for the program. The USDA has also increased the number of application windows per year to four (quarterly) through 2024. This means there is more opportunity to secure funding to add solar to your farm or rural business. Small businesses in eligible rural areas can also apply.

Put your address in the USDA’s Rural Eligibility Map to see if you are eligible. Many agricultural producers also operate rural small businesses and are able to qualify as one or the other.

Competitive grants are available for up to 50 percent of total eligible project costs and loans are available through a competitive application process. Loan guarantees are available for up to 75 percent of total eligible project costs. Combined grant funding and loan guarantees are available for up to 75 percent of total eligible project costs.

The Application And Scoring System

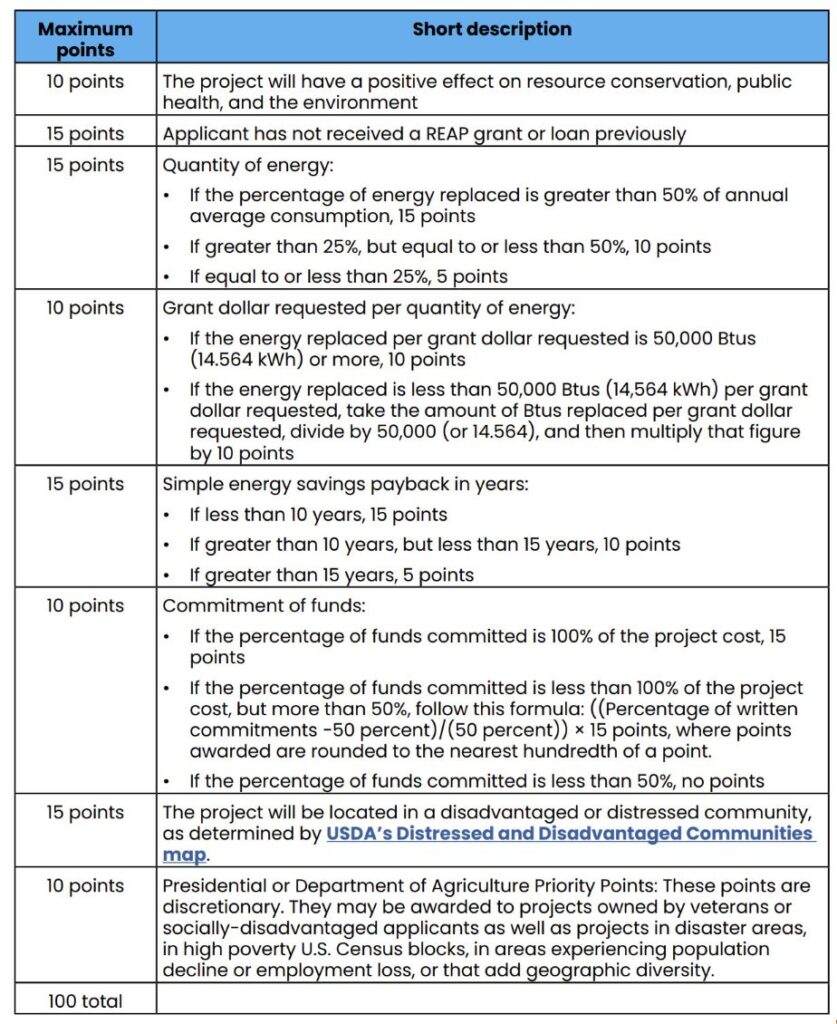

The REAP grant application is scored on a 100-point scale. It has several different categories. A score of 75 points or more will be competitive, though the Office of Rural Development has awarded projects with point scores as low as the high 50s. If this is your first time applying for REAP funds and your solar project produces energy, you will automatically earn at least 35 points. Everyone who is eligible should apply. Your likelihood of success depends on the specific applicant pool.

Below is a breakdown of the points awarded by blocks of information.

About The Application

REAP applicants may apply at any time. There are four application windows per year. Applications will be scored relative to others submitted during the same application window following the deadlines below:

- January 1 – March 31 (Qtr 1)

- April 1 – June 30 (Qtr 2)

- July 1 – September 30 (Qtr 3)

- October 1 – December 31 (Qtr 4)

Starting The Application

Before you start the application, you should reach out to your USDA Rural Development State Energy Coordinator. This will ensure that you have the current and correct application forms and get any questions answered upfront. You can find contact information for your Energy Coordinator via rd.usda.gov/REAP.

Gather the following documents to help the application process go smoothly:

• Three years of tax returns (or at least one full year of tax returns if your business is new)

• Employee payroll if applying as a rural small business

• Electric bills for the last 12 months

• A project quote from your solar installer

• Bank or financial documents showing the committed funds you will use to pay for the solar project

• Your federal Unique Entity ID, if you already have one

Required REAP Forms

The REAP grant application also requires several “standard form” documents. These documents are available through the Rural Energy Coordinator in your state office of USDA Rural Development.

For Pennsylvania, the coordinator’s office information is:

Rana Pfeil

359 East Park Drive, Suite 4

Harrisburg, PA 17111-2747

(717) 237-2288

The forms are also available for download through the USDA Office of Rural Development’s website. You should contact your state’s Rural Energy Coordinator to be sure the forms are current.

The forms that accompany the REAP application are:

• Form SF-424 – Application for Federal Assistance

• Form SF-424C – Budget Information – Construction

• Form SF-424D – Assurances for Construction Programs

• Form RD-1940-20 Request for Environmental Information

The heart of the REAP grant application is Form RD-4280-3A “Application for Renewable Energy Systems and Energy Efficiency Improvement Projects – Total Project Costs of $80,000 or Less”. Confirm you have the right form. There are separate forms for larger projects. Most farms or small businesses apply for the smaller tier “$80,000 and under project size” or mid-tier “$80,000 to $200,000 project size”.

For a more detailed guide to completing this form’s specific blocks of required information, download the Guide in PDF.

After Submission

Applicants who submit an application to the USDA Office of Rural Development for their state should receive an “application complete” response. Then you can proceed with your solar project. However, once the project has been built, you may not reapply if you do not receive funding. As a tip, always submit your REAP grant application before building your solar project.

REAP applicants who are successful should receive notice within 60 days after the relevant application window (quarters 1, 2, 3, or 4) closes. If your application is successful, the USDA Office of Rural Development will contact you and send you a grant agreement with terms of compliance. Once you sign that agreement, the Office will deposit the grant money in the bank account that you provide.