As home solar panel adoption continues to rise in the United States, more financial incentives and options are available for installing solar systems. Since President Joe Biden signed new legislation for larger investments in renewable energy and measures to address climate change, there are provisions for a solar tax credit of 30% for Americans to ‘Go Solar’ over the next decade.

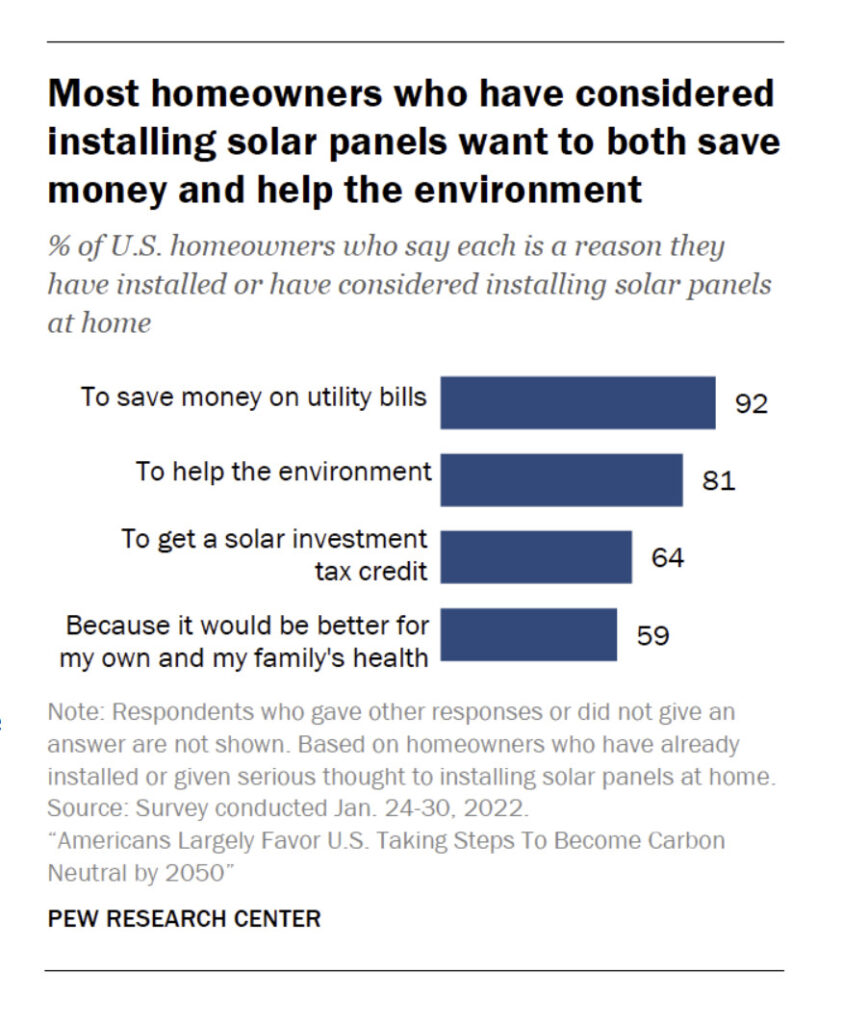

When considering installing solar panels, a number of homeowners realize they can save money on their utility bills, help the environment, improve their families’ health, and get federal help through the investment tax credit. All of these factors help them give serious thought to installing solar panels in their home, according to the PEW research center.

In the state of Pennsylvania, despite a lack of incentives, there is a way to achieve savings when you combine mandatory net metering with the 30% federal tax credit.

Solar Financing Options

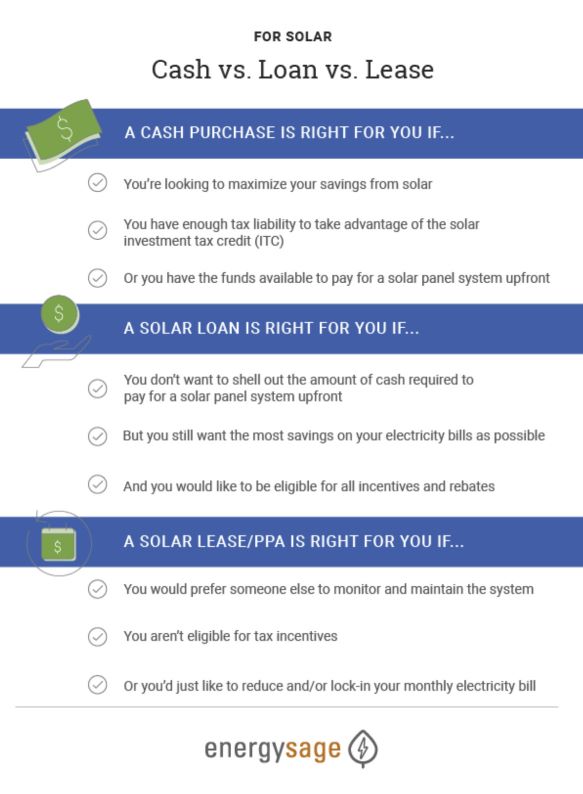

Fundamentally, there are 3 main options for most Americans when it comes to ‘going solar’. However, these may not all be available, depending upon the state you live in. They are:

- Purchasing a solar system

- Loan for a solar system

- Entering into a solar lease or Power Purchasing Agreement (PPA)

Purchasing A Solar System

You can purchase a solar system outright with either cash savings, a home improvement loan or a home equity line or credit. By doing so, you own the system outright and personally benefit from all of the electricity it produces. If your solar panel system is designed to meet 100% of your electricity needs, then your upfront purchase has paid for two to three decades worth of electricity. You are also responsible for the maintenance and upkeep of the system, just like any typical home system. However, most modern solar systems require little to no maintenance, and your installation company may offer maintenance services after your purchase. In most cases, as the owner of the solar system, you are the beneficiary of any tax credits or other incentives that promote solar energy projects. If you sell your home, then the system is included as part of the sale and transferred to the new owner as well.

In Pennsylvania, the average cost of a PV system is $21,675 before considering the tax credit, but after the credit is applied, the net cost drops to $15,173, according to the EcoWatch website. Costs can vary however depending on the particular aspects of your property and energy needs.

Loan For A Solar System

Loans specific to a solar system are a good option because they allow you to ‘go solar’ and own your system without a down payment and oftentimes at a lower cost through lower interest rates if you have good credit. By having a solar loan, you are eligible to receive any rebates or incentives for your solar panel system. By owning the system, you also enjoy the federal tax and any other state programs. You will be responsible for any future maintenance, so it is important to make note of the warranty that comes with the equipment used in building your solar system. The main thing to remember about this type of loan is that it is not assumable by a buyer when you’re selling your home. It must either be paid off or payments continued until the loan is paid in full.

Entering Into a Solar Lease or Power Purchasing Agreement

Many states allow homeowners to lease a solar system for a set time period where they own the system on their property but lease it to you. You benefit by using the electricity it produces while they are responsible for its upkeep and maintenance. You make monthly payments to the company at the agreed-upon rate specified in the lease agreement. Sometimes this can be done with ‘no money down’, but the system is not ‘free’. You should have options when selling your home, but you must check into all of the lease details carefully to know what the specific terms and conditions are for sale and any potential rate increases over time.

A Power Purchasing Agreement (PPA) is very similar to the above description of the solar lease. They are both known as third-party ownership (TPO) where the third-party owner installs the solar panels at your property, maintains them, and then sells you the electricity produced by the solar panels at a predetermined rate. You’ll typically get a set rate for electricity for the next 25 years at about 10 to 30 percent below the current rate you pay, according to the US Department of Energy. While in the past you would pay more for solar each year than you did in prior years, recently the trend is to lock in a specific rate for the entire contract period.

By running the numbers through an online solar calculator, you can see how the different financing options can save you by choosing a cash purchase, solar loan, or lease/PPA agreement. As always, the details within each option for their terms and conditions should be factored into your final decision.

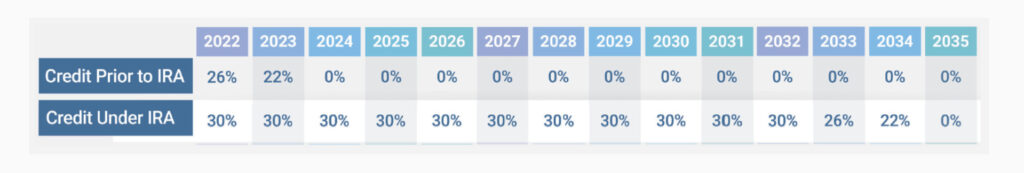

Solar Tax Credits

If you invest in renewable energy for your home, then you may qualify for an annual residential clean energy tax credit. This credit applies to homeowners who install a solar energy system on their property. This is referred to as a solar Investment Tax Credit (ITC) and it was originally enacted in 2006 and then extended with the successful passage of the Inflation Reduction Act in August 2022.

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2033. You may be able to take the credit if you made energy-saving improvements to your home located in the United States, according to the IRS website. The tax credit, unlike a deduction, allows you to subtract the credit from your federal income tax bill. You may claim this credit for improvements to your main home, whether you own or rent it. You can’t claim this credit if you’re a landlord or other property owner who doesn’t live in the home. However, if you use the property solely for business purposes, you can’t claim the credit.

Check the IRS website for specifics, and while credits and incentives help reduce the final cost of a rooftop solar system, always remember that only a CPA or attorney can give legal and tax advice. When consulting with these professionals, make sure to choose those who are experienced at dealing with solar in particular.

Net Metering

Net metering allows residential consumers to send electricity that they do not use back to the grid. This is widely available, but the rules can vary by state and jurisdiction and are subject to change over time. Net metering is strong in Pennsylvania, allowing you to receive credits on the energy generated by your solar panels.

Net metering ensures you get credit for all of the energy your solar system generates, even if you don’t use all of the energy that it produces. On sunny days, your panels will typically generate more energy than your home will use. Net metering allows you to send that excess energy back to the grid so it could be pulled from at a later time, like on cloudy days or evenings when they don’t produce as much.

You receive credits for all of the power your panels produce, and when excess kWh is generated, then those credits can apply toward future bills when your consumption is higher than your production. This can help you reduce your energy bills, maximize your energy savings in Pennsylvania, and help to pay off your system more rapidly.

Pennsylvania has a great net metering program for energy from the Public Utilities Commission (PUC). It requires all investor-owned utilities (IOUs) to credit solar customers for excess energy at the full retail rate. It is a ‘one-for-one’ system for kWs. For every excess kWh your system sends to the grid, you get the equivalent one kWh that you can pull back from the grid for free at a later time.

By understanding some of the financial options as well as weighing the financial incentives available for installing solar, consumers can be better informed on how the financial aspects of this process could impact their decision to move forward on ‘going solar’ for either their home, small business, or farm.